Before

The Ohio Senate

Energy and Public Utilities Committee

Testimony on Substitute House Bill 6

(Version l_133_1512-1)

Presented by Michael Haugh

On Behalf of the

Office of the Ohio Consumers’ Counsel

June 29, 2019

Hello Chair Wilson, Vice Chair McColley, Ranking Member Williams and members of the Committee. Thank you for this opportunity to testify. My name is Michael Haugh. I am testifying as a consultant on behalf of the Ohio Consumers’ Counsel, after formerly serving as OCC’s assistant analytical director. OCC is the state’s representative of over four million residential utility consumers. I have previously testified for OCC in opposition to House Bill 6. OCC appreciates the consumer protections in the Senate changes to the Substitute Bill that was released on June 26th. But fundamentally the bill remains a bailout of aging nuclear power plants, at public expense, for bankrupt FirstEnergy Solutions and its big Wall Street creditors. And the bill enables a continued bailout of the 1950’s OVEC coal power plants, at public expense, for big utilities and their investors. (Lines 1271-1272).

Even in its improved form, the bill will transfer about a billion dollars in above-market charges from Ohio families and businesses to FirstEnergy Solutions’ investors. That is bad. The bill similarly will allow the continued bailout of the two OVEC coal plants, at a total consumer cost of about $300 million after the end of the utility rate plans where the PUCO ordered the current subsidies. That is also bad. Those two coal plants include the Clifty Creek plant that is out of state in Madison Indiana. Given the bill’s approach of subsidies instead of competitive markets, the Ohio Consumers’ Counsel continues to oppose the bill and the utility subsidy culture that it reflects.

Attachment 1 is testimony last session from the Industrial Energy Consumers that explains the fallacies of subsidizing the OVEC coal plants. I do appreciate the Senate’s truth in ratemaking where the bill no longer describes the OVEC plants as a “national security resource,” which they are not.

I also appreciate the Senate’s removal of the language requiring electric consumers of AEP, Duke and DP&L to subsidize the former share of bankrupt FirstEnergy Solutions for the OVEC coal plants’ losses. But past experience reflects that the PUCO likely will allow utilities this additional OVEC coal subsidy at public expense even without a law. So for consumer protection, the bill should end these coal subsidies now or at least no later than when the current PUCO subsidy orders expire.

All these aging power plants that the General Assembly will subsidize with public money are the outdated technologies of the old energy economy. Worse, the subsidies will roll up (not roll out) the welcome mat for investment in the new energy economy in Ohio, which includes the synergistic use of some of the world’s lowest priced natural gas right here in Ohio. Investors in the competitive power plants of the future should be welcomed in Ohio. They are the future job creators and technology innovators, who will not be attracted to a business climate in Ohio where their competitors get subsidized with corporate welfare at public expense.

Importantly, the competitive markets that the bill undermines have provided low-cost power to Ohio families and businesses. Low electric prices encourage business investment and job creation.

Ohio should not be picking winners and losers by providing subsidies to power plants that cannot compete in the wholesale energy markets. The subsidy approach is contrary to the competitive vision of Ohio’s 1999 electric deregulation law, and we commend that legislative vision for its consumer protection.

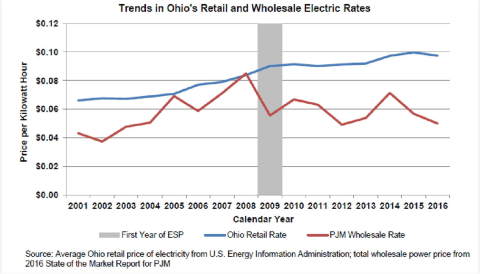

A graph (from page 2 of a Legislative Service Commission Fiscal Note for H.B. 247 (132nd General Assembly)) depicts my concerns.

The LSC graph shows a decrease in PJM wholesale electric rates since 2008. That should be good for consumers. But the LSC graph shows a rise in Ohio retail electric prices since 2009. That is bad for consumers. LSC explained that “the lack of correlation between wholesale and retail prices emerges around calendar year 2009, which is the same year that Ohio’s utilities began operating under ESPs.” It was Ohio’s 2008 energy law (S.B. 221) that created electric security plans with their government intrusion into competitive markets and subsidies at consumer expense. Here we go again with H.B. 6.

One of the Senate’s improvements is to the woefully inadequate audit provision. (Lines 309 to 343) I commend the new audit provisions on lines 309-343 that provide some consumer protections. What is happening here is deregulated FirstEnergy Solutions and its future Wall Street owners are being given access to monopoly customers for subsidies akin to treating FES like a monopoly utility (which it is not). The result for customers is asymmetrical and unfair. Customers are paying subsidies to FirstEnergy Solutions, but without the protections of regulation that would otherwise come with imposing such charges on monopoly customers. A prime example of this missing regulation is the section of the bill that exempts the PUCO audit from the statute for hearings – R.C. Chapter 4903. (Lines 344 - 345) That is unfair and wrong for consumers paying the charges. It should be corrected with a fair and open process at the PUCO, using a typical regulatory framework that gives interested parties a voice in the process. Attachment 3 to my testimony is OCC’s recommended amendment to the bill for customer protection through a fair and open audit process that includes due process protections of notice and a hearing.

Furthermore, auditors should be given an effective standard to audit against, which the bill still lacks. An effective standard would be a simple standard that power plants will not be subsidized at public expense if their revenues are meeting their operational expenses. That standard should also be added to the bill. Already the Senate has heard testimony with the controversy over whether the power plants are or will be profitable, with new information that the plants will be profitable without subsidies. Experience – such as with the disastrous ratemaking for consumers in 2008’s Senate Bill 221 – shows that consumers do not fare well (they fare poorly) with ambiguity for alleged consumer protections in ratemaking law.

Further, lines 125-132 state the Ohio Air Quality Development Authority “may decertify a qualifying resource” if the owner no longer requires payments. That language should be strengthened by requiring the OAQDA to decertify the resource (power plant) if the audit finds that the plant’s operational costs are being met though all revenues it receives. Yesterday evening FirstEnergy Solutions filed its monthly operating report with the Bankruptcy Court, for May 2019. The report is Attachment 4. The report includes a profit and loss statement for each of FES’s legal entities that are in bankruptcy. Page 2 of the report, on the line labeled “Operating Margin,” shows a positive operating margin for FES’ nuclear generation businesses. FES’s nuclear generation business consists of two companies: FirstEnergy Nuclear Generation (FENG) and FirstEnergy Nuclear Operating Company (FENOC). According to the report, FENG had a positive operating margin of $18.4 million in May and, since the bankruptcy filing, FENG had a cumulative positive operating margin of $55.3 million. FENOC had a positive operating margin of $1.8 million in May and a cumulative operating loss of only $5.4 million since the bankruptcy filing. When you combine the results of FENG and FENOC, the figures show that FES’s nuclear operations have produced a positive operating margin of almost $50 million since the bankruptcy filing in spring 2018. In fact, based on the financials, the nuclear business appears to be the only part of FES’s businesses that has had positive operating margins since it filed for bankruptcy. We do note that the information is aggregated between the Ohio and Pennsylvania nuclear plants. In any event, the Senate should carefully assess this information, which seems to be a factor weighing against subsidizing the nuclear plants.

We have appreciated what we understand is an intention by the Senate to remove extraneous issues from the bill. One extra issue that has not been removed from the bill (but should be) is subsidies for big industrial corporations at the expense of Bob and Betty Buckeye and other customers.

In this regard, lines 620 - 625 would provide a subsidy for “trade-exposed industrial manufacturers.” For these large industrial customers, the bill requires the PUCO to “attempt to minimize electric rates to the maximum amount possible,” when ruling on a so-called “reasonable arrangement.” The PUCO already has the authority to determine rate making without a statute requiring it to “maximize” a subsidy for some customers. Every dollar that the utility does not collect from the industrial customer for its “minimized” electric rates will be a dollar charged by the utility for subsidies from other customers. The subsidies for “trade-exposed industrial manufacturers” have nothing to do with bailouts for nuclear and coal plants. And these subsidies are contrary to the House’s theme that the bill should save money for consumers. The issue should be removed from the bill and considered in a stand-alone bill, if needed. As we have testified, subsidies are contagious, and there has been a line forming at the Statehouse by those who want subsidies. The line for subsidies should be closed. The provision should be removed. The Senate’s improvements, while appreciated, don’t save the bill from itself – it’s still a bailout of uneconomic power plants subsidized by captive customers. Nonetheless, I would like to identify a few other Senate improvements in this Substitute Bill. The removal of the decoupling provision protects consumers from utilities needlessly charging customers for reduced usage. The elimination of shared savings (utility profits) after 2020 in the utilities’ energy efficiency programs has been long needed, as OCC has advocated. (Line 1113). This limitation on utility profiteering (so-called shared savings) from their energy efficiency programs is protective of consumers. Ohio law should not allow FirstEnergy, AEP, DP&L, and Duke to charge consumers for any profits on their energy efficiency programs.

Further, Lines 1326-1329 are a change to prevent non-participating customers from having to pay subsidies for on-site renewable projects. Although this type of project could and should be provided by the competitive market, it is appreciated that residential customers will not be paying subsidies for these projects.

Last week was a real bad week, that should have been a good week, for two million consumers of FirstEnergy. They succeeded in a Supreme Court decision to overturn the PUCO’s misuse of the 2008 energy law. The PUCO had granted a subsidy to FirstEnergy of about a half-billion dollars from consumers for a so-called “distribution modernization rider” (that the PUCO didn’t require FirstEnergy to spend on distribution modernization). The connection to H.B. 6 is that it was a subsidy and the subsidy was for credit support that would relate in part to the troubled finances of the ultimately bankrupt FirstEnergy Solutions. It should have been a good week for consumers with the end of the charge. But it was a bad week for consumers with the Court’s decision that FirstEnergy can keep the improper charges without a refund of nearly a half-billion dollars to Ohio families and businesses.

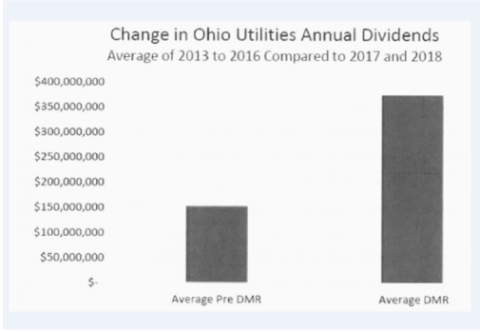

One way to bring more of the needed balance for consumers to this bill is to fix the problem of consumers being denied refunds, which the Court previously stated can be solved by the General Assembly. In other words, this bill should be amended to enable refunds when any legal authority such as the Court, FERC or the PUCO later finds charges to be improper. Further, a consultant audit released this month by the PUCO, regarding the same FirstEnergy distribution modernization rider, is revealing for House Bill 6 regarding what can happen with subsidies. According to the auditor, during the time the distribution modernization rider was being collected from customers, dividends paid by the FirstEnergy utilities to their parent “increased considerably” (averaging $375 million) compared to the dividends prior to the rider (averaging just $152 million). So the subsidy is transferring wealth from Ohioans to investors. See PUCO Case No. 17-2474-EL-RDR, Oxford Advisors Compliance Review, Mid-term Report

at p. 12 (June 14, 2019): http://dis.puc.state.oh.us/TiffToPDf/A1001001A19F14B63203J01876.pdf Here is one of the PUCO auditor’s charts showing the correlation between consumers’ subsidy payments to FirstEnergy and FirstEnergy transferring consumer wealth to its investor/owner:

We recommend that FirstEnergy, its affiliates and future former affiliates like FES make money based on their achievements in the market and not through government-imposed hand-outs from Ohio families and businesses.

In this regard, attached is OCC’s “Subsidy Scorecard” (Attachment 2). The Scorecard shows the billions of dollars that FirstEnergy and the other Ohio electric utilities have charged consumers for subsidies since the 1999 Ohio deregulation law.

And, for balance for consumers, I recommend other protections. Those include removing the FirstEnergy profit protection from the budget bill (H.B. 166). Or, even better, delete the word “significantly” from the 2008 law, as in “significantly excessive earnings,” so that consumers would be protected from paying any excessive profits. The profit issue could also be solved by eliminating electric security plans or at least improving their worst piece parts such as removing the allowance of a utility “veto” of a PUCO order that modifies its security plan; fixing the profits issue as described above; and fixing the “more favorable” than a market rate offer standard to prohibit use of qualitative factors for the PUCO’s judging of utility proposals for electric security plans.

OCC appreciates the opportunity to testify at this hearing. We have endeavored to be helpful for your important deliberations, within the tight timelines for analysis of the new substitute bill released on June 26.

In conclusion, the Substitute Bill is a better bill than the House version but it should be judged on its fundamental policy to subsidize power plants in a state that has (or had) a vision for deregulated competitive markets. By that standard, the bill is bad for consumers. Instead of the invisible hand of the market, there continues to be the heavy hand of government in the market. That should have ended after 1999 and it should at least end now. I urge you to vote against Substitute House Bill 6.

Thank you for this opportunity to testify.