Before

The Ohio Senate

Energy and Public Utilities Committee

Testimony on Substitute House Bill 6

Presented by Michael Haugh

On Behalf of the

Office of the Ohio Consumers’ Counsel

June 19, 2019

Hello Chair Wilson, Vice Chair McColley, Ranking Member Williams and members of the Committee. Thank you for this opportunity to testify in opposition to a bad bill that could leave Ohioans across the state wondering why they are paying a tax for a billion-dollar bailout of two nuclear power plants on the shores of Lake Erie. And asking a similar question about bailing out two ancient coal plants, one of which is in Indiana. I am Michael Haugh, testifying for the Ohio Consumers’ Counsel, where I provide consulting services for OCC’s consumer advocacy. Previously I was the assistant director of OCC’s Analytical Department. The Consumers’ Counsel is the state’s representative of millions of residential utility customers. My background is nearly 25 years in the energy industry, working on both the regulated and deregulated sides of the energy markets in government and private industry.

The PJM Independent Market Monitor, Dr. Joseph Bowring, has described subsidies as “contagious,” meaning that subsidies beget more subsidies. One need look no further than the line of special interests forming for corporate welfare under H.B. 6. Ohioans would pay a billion dollars in subsidies to FirstEnergy Solutions and its big Wall Street bankruptcy creditors for its uneconomic nuclear plants. Ohioans would pay a half-billion dollars in subsidies to AEP, Duke and DP&L for two 64-year-old coal plants (one of which is in Indiana). And Ohioans would pay more subsidy to AEP and others for solar plants. All this would happen in a state that twenty years ago made the right move to deregulate power plants in favor of competitive markets for consumer protection instead of government interference in those markets.

Since deregulation in 1999, Ohioans have been made to pay an astounding $15 billion in subsidies to electric utilities. We track those subsidies in the Subsidy Scorecard that is Attachment 1 to my testimony.

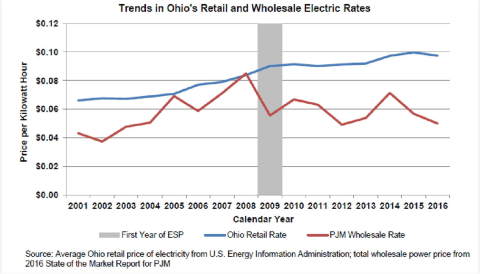

Attachment 2 is a Legislative Service Commission Fiscal Note from last session for H.B. 247. It contains a graph on page 2 showing a decrease in PJM wholesale electric rates since 2008. That is good for consumers. What’s bad for consumers is that the graph shows the rise in Ohio retail electric prices since 2009. LSC noted “the lack of correlation between wholesale and retail prices emerges around calendar year 2009, which is the same year that Ohio’s utilities began operating under ESPs.” It’s not a coincidence that 2009 is the year following Ohio S.B. 221’s intrusion in competitive markets. Here is the LSC graph:

I commend for your consideration FirstEnergy’s words from October 19, 2011. Then, in testimony before the Ohio House Public Utilities Committee, FirstEnergy Vice-President and General Counsel Leila Vespoli testified that: “...competitive markets work. They deliver the lowest price over the long-term to consumers, and the proof is undeniable.” (See Attachment 3) The General Assembly’s deregulation of power plants works for Ohio families and businesses. Deregulation has contributed to competitive wholesale markets producing billions of dollars in savings for Ohio electric customers. Researchers at The Ohio State University and Cleveland State University concluded that Ohioans saved over $15 billion between 2011 and 2015 from competition. They projected savings of another $15 billion in savings between 2016 and 2020. (Link: https://engagedscholarship.csuohio.edu/urban_facpub/1416/)

Last month the Ohio Consumers’ Counsel Governing Board adopted a resolution supporting competitive power plant markets and opposing subsidies for power plants at the expense of Ohioans. The resolution states, in part:

[T]hat the Governing Board of the Office of the Ohio Consumers’ Counsel supports power plant competition and deregulation as envisioned by the Ohio General Assembly in 1999 to deliver lower prices and higher innovation to consumers.

Further the resolution states:

[T]hat the Governing Board of the Office of the Ohio Consumers’ Counsel opposes any legislation (including House Bill 6) that would charge Ohio utility consumers (contrary to deregulation and competitive generation markets that have emerged) to subsidize any type of generation (including nuclear power plants).

The full Governing Board resolution is Attachment 4 to my testimony. Regarding the bill’s coal plant bailout, Attachment 5 is the Senate testimony of the Ohio Industrial Energy Users last session. IEU expressed concerns about making customers subsidize the OVEC coal plants. The IEU testimony provides a good explanation of why these plants should not be subsidized at consumer expense. Codifying the coal plant subsidies would favor AEP, Duke and DP&L, against consumers, by removing the PUCO’s discretion to end the subsidies. And the bill would harm consumers by requiring AEP, Duke and DP&L consumers to subsidize the coal plant costs that FirstEnergy Solutions is shedding in bankruptcy (lines 1257- 1261 ). Further, the bill would harm residential and small business consumers by making them pay more and enabling the biggest business customers to pay less than they currently pay for the coal subsidies that the PUCO authorized (Lines 1371-1384).

We appreciate PJM’s testimony before this Committee on June 5, 2019 which included a study of how markets would work without the FirstEnergy Solutions nuclear plants. OCC and the Pennsylvania Commission had requested the study. Note also that these power plants that Ohioans would be made to subsidize are not needed for the reliability of their electric service. The regional wholesale power markets do not need the Davis-Besse and Perry nuclear plants and the OVEC coal plants for reliability. In fact, they don’t need those plants for anything. PJM has procured more than enough power to serve consumers for the next three years. Specifically, PJM’s procurement for the 2021/2022 planning year has been successful without including the Davis-Besse and Perry plants in the reliability mix. The PJM capacity auction has a reserve of 21.5%, 5.7% above the target reserve margin to safeguard reliable service. (See Attachment 6) In other words, there will be light when Ohioans flip on their light switches. Bill proponents claim customer savings from elimination of the utilities’ energy efficiency programs. But the bill does not eliminate the utilities’ ability to continue these programs, with PUCO approval. In fact, the utilities can reinstate the energy efficiency programs the day after they are required to end them, if the PUCO approves. (lines 1772-1773) The bill refers to these programs as “voluntary programs” (line 1755); however, these programs would not be voluntary for residential and small commercial customers who are asked to pay for them. But large customers are favored with the ability to opt-out of paying for these programs. In the current energy efficiency programs utilities can charge customers for profits, known as “shared savings.” Utility profits charged to Ohioans in 2018 totaled over $50 million for energy efficiency programs: $25 million paid by AEP customers; $12 million paid by FirstEnergy customers; $9 million paid by DP&L customers; and $4 million paid by Duke customers. It should be noted the $9 million in profit DP&L charged its customers was based on a $20 million program. Given these profits, there is little doubt the utilities will want to voluntarily continue these programs, which will undercut the customers savings claimed by the bill’s proponents. We do not recommend the end of utility energy efficiency programs (which can produce customer savings), but there needs to be much more customer protection. The law should limit the costs and profits that utilities are allowed to charge to customers. And the programs (and customer funds) should be managed by independent administrators with the customers’ interest foremost, instead of run by utilities.

Another way this Bill can increase customers’ electric bills is through the utility purchase power agreements found on lines 1415-1448. These agreements permit the utility to charge big business customers a below market rate and then charge all other customers for the shortfall. This provision is for services that are offered in the competitive marketplace and those services should not be subsidized by other customers. It should be removed from this Bill.

On June 4th Ray Gifford testified before this Committee in support of HB 6 and its nuclear subsidies. During Senator questioning he acknowledged representing FirstEnergy Solutions. Mr. Gifford commented that other states had acted to preserve nuclear power plants and that Ohio “should use the same ZEC (zero emission credit) mechanism to preserve its nuclear plants.”1 But in an earlier May 2018 article that he and a colleague published, Mr. Gifford contradictorily wrote that “No ‘around market’ solution whether designed to develop a new state-level acronym and product like a ZEC or expand a competitive solicitation to let nuclear participate, will solve the RAMM’s [Regional Administrative Market Model] fundamental problems.”2 And Mr. Gifford urged FERC to “put an end to the ‘around market’ and ‘in-market’ madness.” Mr. Gifford got it right in 2018, and not earlier this month.

Recommendations: This Bill is bad for Ohio electric utility customers. Please vote against this legislation. If there is a desire to legislate on this issue, here are my suggestions to improve the Bill:

1. Limit the bill to only consideration of a nuclear subsidy. All other bill provisions should be taken up in other stand-alone legislation, if at all. The Committee Chair has suggested that the Senate will consider comprehensive energy legislation. There, the bill’s provisions that largely favor big utilities, at the expense of Bob and Betty Buckeye, can be balanced or discarded in favor of pro-consumer provisions like reforms proposed in last session’s H.B. 247 by Rep. Romanchuk. Attachment 7 to my testimony is a list of topics for addressing in future energy policy legislation.

2. Do not make Ohioans subsidize more than 1,200 MW of nuclear capacity.

3. Do not make Ohioans subsidize the ancient, dirty-air OVEC coal plants of AEP, Duke, DP&L, and pre-bankruptcy FirstEnergy Solutions. This issue is addressed earlier in this testimony. And it’s addressed in my Attachment 5, which is the testimony last session from the Industrial Energy Users.

4. Do not make Ohioans subsidize utility-scale solar plants. There is no need to add a solar subsidy for the benefit of large solar developers (50 MW or greater), including AEP. This provision is more proof that subsidies are “contagious.”

5. There should be a strict test to prohibit a nuclear subsidy if a plant is profitable. The bill should deny subsidies to applicants unless they can prove with evidence that they are unprofitable. Further, the provision in the bill for audits is very weak and needs substantial improvement for it to work as a consumer protection. Audits should include a determination of whether the subsidized power plant is profitable without the subsidy.

6. Limit the nuclear subsidy to three years or less. Customer subsidies of generation should not be condoned and especially not as a long-term business model for a power plant.

7. Set a much lower strike price for reducing the nuclear subsidy if market prices increase and in turn change the provision to reduce what consumers pay into the “Clean Air” subsidy fund. The alleged consumer protection of reducing the subsidy if market prices increase is little or no protection for consumers. The strike price of $46 is much too high, and is unlikely to be achieved during the effective period of the bill. The strike price should be substantially reduced to under $30 per mwh. (Lines 537-544) This bill is about making Main Street bail out Wall Street. It’s great for FirstEnergy Solutions (and its big Wall Street bankruptcy creditors), and for AEP, Duke, and DP&L. But it’s real bad for Bob and Betty Buckeye who would pay for the corporate welfare to big utilities. Twenty-six Ohio counties have populations with more than 14.5 % living with food insecurity. Thirty-six Ohio counties have populations with more than 15% living in poverty. I urge you to protect millions of Ohioans by voting against this legislation.

Thank you for your consideration.

1 : http://search-prod.lis.state.oh.us/cm_pub_api/api/unwrap/chamber/133rd_… (See page 1).

2 https://www.wbklaw.com/uploads/file/Articles-%20News/2018%20articles%20publications/White%20Paper%20-%20Market%20Design%20Issues%20-%20May%202018).pdf (pages 1 and 20).